Latest Updates & Issues

A persuasive advocate should be up to date on the key issues affecting the opera sector.

Read the latest news on advocacy efforts prepared by OPERA America's director of government affairs and civic practice — and check back for regular updates.

Review the key issues affecting opera and the arts with resources and downloadable briefs prepared by the Cultural Action Group.

Advocacy Updates

Issued February 20, 2026

The Supreme Court strikes down President’s tariffs imposed under emergency powers law

On Friday, in a 6-3 decision, the Supreme Court struck down the tariffs unilaterally imposed under the 1977 International Emergency Economic Powers Act, or IEEPA, including the tariffs levied on nearly every country in the world last spring — as well as and other IEEPA-based levies imposed on Canada, Mexico and China. Despite Friday’s ruling, other broad-based levies remain in effect. The President had utilized another law—Section 232 of the 1962 Trade Expansion Act—to impose sector-specific tariffs on steel, aluminum, automobiles, copper, and lumber. While the President can continue to impose tariffs, it must now be done under different legal authorities.

NEA Research Grant Application Guidelines

The National Endowment for the Arts (NEA) is offering two grant programs through its Office of Research & Analysis:

-

Research Grants in the Arts support research studies that investigate the value and/or impact of the arts in American life. Cost share grants of $20,000 to $100,000 will be awarded.

-

NEA Research Labs fund long-term research agendas that include multiple empirical studies and the dissemination of various products or services for promoting public knowledge about the arts and their contributions to American life. Each Lab must include an interdisciplinary team of researchers and a partnership with at least one arts organization or working artist. Cost share grants of $100,000 to $300,000 will be awarded.

Application guidelines for the present round of funding are available on the NEA website. The upcoming deadline is March 23, 2026.

NEW: Added resources include a series of tutorial videos that cover the basics of the Research Awards grant programs. Watch the full playlist, or go to the Applicant Resources page to find links for individual videos.

Issued February 13, 2026

With no agreement reached on Department of Homeland Security funding, Congress has adjourned for the planned recess

Lawmakers departed Washington on Thursday without finalizing an immigration enforcement overhaul, which nearly guarantees a partial shutdown of the Homeland Security Department when current funding expires this weekend. Bipartisan negotiations on an immigration plan are expected to continue during the recess; however, it is expected that neither chamber will return to the Capitol early unless substantial progress is achieved. The impact of a partial shutdown would be limited at ICE and Customs and Border Protection, as these agencies received approximately $75 billion through last year’s budget reconciliation law. Agencies effected by the shutdown would include Transportation Security Administration, Federal Emergency Management Agency, Cybersecurity and Infrastructure Security Agency, and the Coast Guard.

Update courtesy of Congressional Quarterly

Sens. Schiff, Curtis Introduce Bipartisan Bill to Protect Creators’ Work, Implement Transparency Safeguards in AI Model Development

On February 10, U.S. Senators Adam Schiff (D-Calif.) and John Curtis (R-Utah) introduced the Copyright Labeling and Ethical AI Reporting (CLEAR) Act, bipartisan legislation that would protect the intellectual property rights of creators and encourage transparency in the development of artificial intelligence (AI). The bill would require companies to disclose their use of copyrighted work to train generative AI models, implementing ethical guidelines and protections to promote transparency. More can be found at the press release.

Sens. Peters and Lankford Introduce Bipartisan Legislation to Improve Federal Grant Application Process

This week, U.S. Senators Gary Peters (D-MI), Ranking Member of the Homeland Security and Governmental Affairs Committee, and James Lankford (R-OK) introduced bipartisan legislation to improve the administration of grant programs across the federal government. Governments, organizations, and businesses that are smaller, more rural, or have more limited resources often face difficulties when applying for federal grants because they lack the resources to navigate the complicated application processes. The Streamlining Federal Grants Act would simplify the application process to improve access to federal grants for communities across the country. More can be found at the press release.

House Ways & Means Committee Hearing on Nonprofit Oversight

The Ways & Means Committee held a hearing this week, “Foreign Influence in American Non-profits: Unmasking Threats from Beijing and Beyond.” During the session, there was bipartisan discussion regarding the potential for modernization or reform of the IRS Form 990 to incorporate information and further transparency on fiscal sponsorships and foreign donors.

BEA Announcement: Arts and Cultural Production Satellite Account No Longer Regularly Produced

The U.S. Bureau of Economic Analysis (BEA) announced this week that the BEA will no longer regularly produce the Arts and Cultural Production Satellite Account. These reports were essential to capturing and conveying the economic impact of the sector and were utilized widely. The latest report, covering 2023 and prior years, was released April 2, 2025.

Michael McDonald Nominated as National Endowment for the Humanities Chair

Michael McDonald, currently serving as Acting Chair of the National Endowment for the Humanities, has been nominated to serve as permanent Chair.

Administration Appeals Court Ruling on IMLS

The Administration recently filed an appeal against the November 21, 2025, permanent injunction ruling. The permanent injunction will stay in place until the court considers the Administration's appeal. Recap of Ruling: On November 21, 2025, the U.S. District Court for the District of Rhode Island granted a permanent injunction in Rhode Island vs Trump stating attempts to dismantle the Institute of Museum and Library Services (IMLS) were unlawful, unconstitutional, and in direct violation of Congress's clear statutory directives. The injunction prevents the Administration from further carrying out the Executive Order relating to IMLS and vacates the Administration's actions. The Administration complied with the ruling and has reinstated the terminated grants.

Update Courtesy of American Alliance of Museums

Issued February 6, 2026

EEOC Investigation into Nike Over Discrimination

The Equal Employment Opportunity Commission (EEOC) is investigating claims that Nike has allegedly discriminated against white employees and job applicants through its diversity policies. The investigation was disclosed in the motion filed in Missouri federal court demanding that Nike fully comply with a subpoena for information. The EEOC sought the company's criteria for selecting employees for layoffs, how it tracks and uses worker race and ethnicity data, and information about programs which allegedly provided race-restricted mentoring, leadership, or career development opportunities, according to court documents.

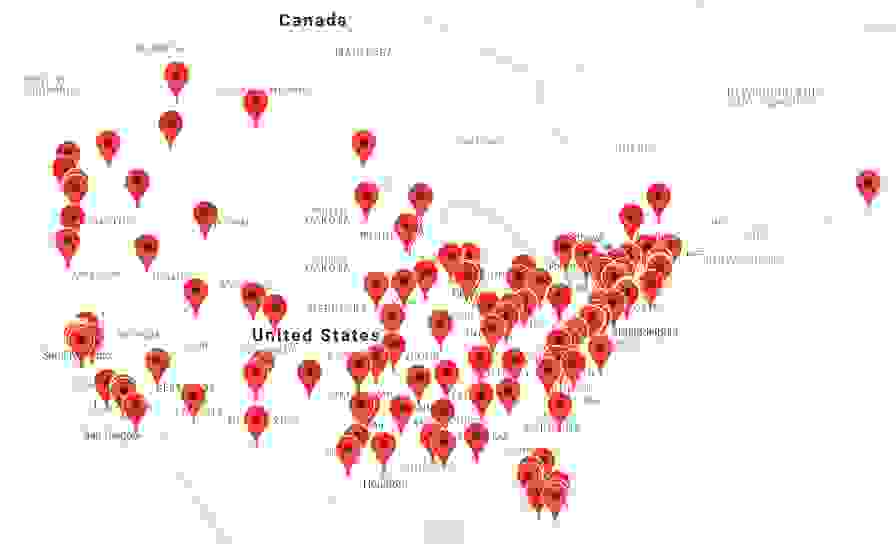

Upcoming Congressional Recesses — Great Time to Meet with Legislators in Home Districts!

While Fiscal Year 2026 appropriations for the cultural agencies are now officially law, one of the most helpful things advocates can do at this moment is to stay engaged by keeping an open and ongoing conversation with policymakers about your work, your impact, and how federal arts funding supports your communities as we look ahead to FY27 appropriations. Below is a chart showing when representatives will be in their home districts over the next two months. Additionally, you will find helpful reminders on how to effectively engage with elected officials in OPERA America’s advocacy toolkits!

|

House at home: |

Senate at home: |

Advocacy Updates

Issued February 10, 2026

Congress Ends Partial Shutdown, Department of Homeland Security Negotiations Continue

Earlier this week, Congress ended the partial government shutdown by passing a bipartisan appropriations package that funds the remaining agencies, including the Department of Labor, Health and Human Services, Education, and Related Agencies, through September 30. The package also includes a two-week continuing resolution for the Department of Homeland Security (DHS) through February 13, to allow for additional negotiations on the final bill.

EEOC Investigation into Nike Over Discrimination

The Equal Employment Opportunity Commission (EEOC) is investigating claims that Nike has allegedly discriminated against white employees and job applicants through its diversity policies. The investigation was disclosed in the motion filed in Missouri federal court demanding that Nike fully comply with a subpoena for information. The EEOC sought the company's criteria for selecting employees for layoffs, how it tracks and uses worker race and ethnicity data, and information about programs which allegedly provided race-restricted mentoring, leadership, or career development opportunities, according to court documents.

Upcoming Congressional Recesses — Great Time to Meet with Legislators in Home Districts!

While Fiscal Year 2026 appropriations for the cultural agencies are now officially law, one of the most helpful things advocates can do at this moment is to stay engaged by keeping an open and ongoing conversation with policymakers about your work, your impact, and how federal arts funding supports your communities as we look ahead to FY27 appropriations. Below is a chart showing when representatives will be in their home districts over the next two months. Additionally, you will find helpful reminders on how to effectively engage with elected officials in OPERA America’s advocacy toolkits!

|

House at home: |

Senate at home: |

Key Advocacy Issues

Prepare to take action by reviewing the key issues with online resources and downloadable briefs prepared by the Cultural Advocacy Group

Issue Briefs

The below Issue Briefs were prepared by the Cultural Advocacy Group, a collaboration of arts and culture stakeholders working collectively to advance federal policy and can be used in federal advocacy efforts.

National Endowment for the Arts Fiscal Year 2026 Issue Brief

Legal Analysis

The following resources can support discussions about the legal landscape for nonprofits.

The Impacts of the Recent Executive Orders on Nonprofits from the National Council on Nonprofits helps nonprofits stay abreast of executive orders and their related actions.

The Fierce Urgency of Now: Messages that Advance Diversity and Equal Opportunity, is produced by the Leadership Conference on Human and Civil Rights. It synthesizes insights from recent public perception studies and outlines a broad messaging approach designed to resonate across the political spectrum.

Despite Attacks, Civil Rights Protections Endure, produced by Democracy Forward, this is a 2025 supplemental report to the 2024 publication, Safeguarding and Strengthening Diversity, Equity and Inclusion (DEI) Initiatives, which tracks key legal developments over the last year.

Advancing Diversity, Equity, Inclusion, and Accessibility in a Time of Uncertainty: What Employers Need to Know is a short explainer produced by the Legal Defense Fund, Asian Americans Advancing Justice – AAJC, Democracy Forward, LatinoJustice PRLDEF, the Lawyers’ Committee for Civil Rights Under Law, and the National Women’s Law Center.

Preparing for Immigration Enforcement: Keeping Music and Performing Arts Venues, Staff, Artists and Audiences Safe, from Tamizdat, is designed to help performing arts and music venues in the US know how to best prepare for enforcement from Immigration and Customs Enforcement (ICE.)

Settlement Update from the Council on Foundations is helpful reading for organizations that operate fellowships or professional development programs and outlines how the September 2024 American Alliance for Equal Rights v Fearless Foundation case addresses a program eligibility criteria.

The Department of Justice Is Expanding Its Definition of "Illegal DEI"—What Federal Contractors and Grant Recipients Need to Know is produced by Venable LLP and is a helpful overview of recent changes in Department of Justice positions.

Last updated January 2026

Charitable Giving

The following resources can support discussions about philanthropic trends and charitable giving.

The Association of Fundraising Professionals' one-page overview explains how to make the most of this new giving incentive for taxpayers that do not itemize their returns.

The Tax Foundation's overview explains policies in H.R. 1 that will affect how many taxpayers itemize, and how itemizers may benefit from deducting charitable donations.

Last updated December 2025

Visa Processing

The League of American Orchestra and Association for Performing Arts Professional's website Artists from Abroad, provides essential tips, templates, and updates for seeking the O and P visas required for artists.

This Issue Brief was prepared by the Cultural Advocacy Group, a collaboration of arts and culture stakeholders working collectively to advance federal policy.

Last updated December 2025

Creative Expression

The following resources can support discussions about creative expressions, programming, and artistry.

National Coalition Against Censorship provides resources to help artists and all citizens promote free expression and challenge censorship.

PEN America’s Flashpoints Educational Resource Guide shares past and current debates about free speech in the context of protest, dissent, and the quest for social change.

The Censorship Horizon: A Survey of Art Museum Directors raises important and relatable issues concerned with both censorship and self-censorship in the face of political pressure.

Last updated December 2025

Creative Workforce

The following resources can assist in navigating careers within the creative and freelance economy.

Riskier Business: A Guide for Dramatists and Performing Arts Workers on Finding Affordable Health Coverage and Care, a free, comprehensive online guidebook designed to help theatre workers and performing arts professionals navigate the world of health insurance, find affordable coverage and care, and become their own best advocates. The guide highlights recent legislative and regulatory changes that will affect consumers’ coverage for 2026. While the guide largely focuses on coverage options and resources in New York, it also includes information for those living in other states.

Last updated December 2025